Overview

I’ve always searched for an app that would make managing my finances effortless - something simple, yet powerful. One that doesn’t just show you numbers but helps you make sense of them, take action, and plan for what really matters. Frustratingly, that app didn’t seem to exist. Tools were either too basic, overwhelming, or so impersonal that they left me feeling disconnected from my own financial goals.

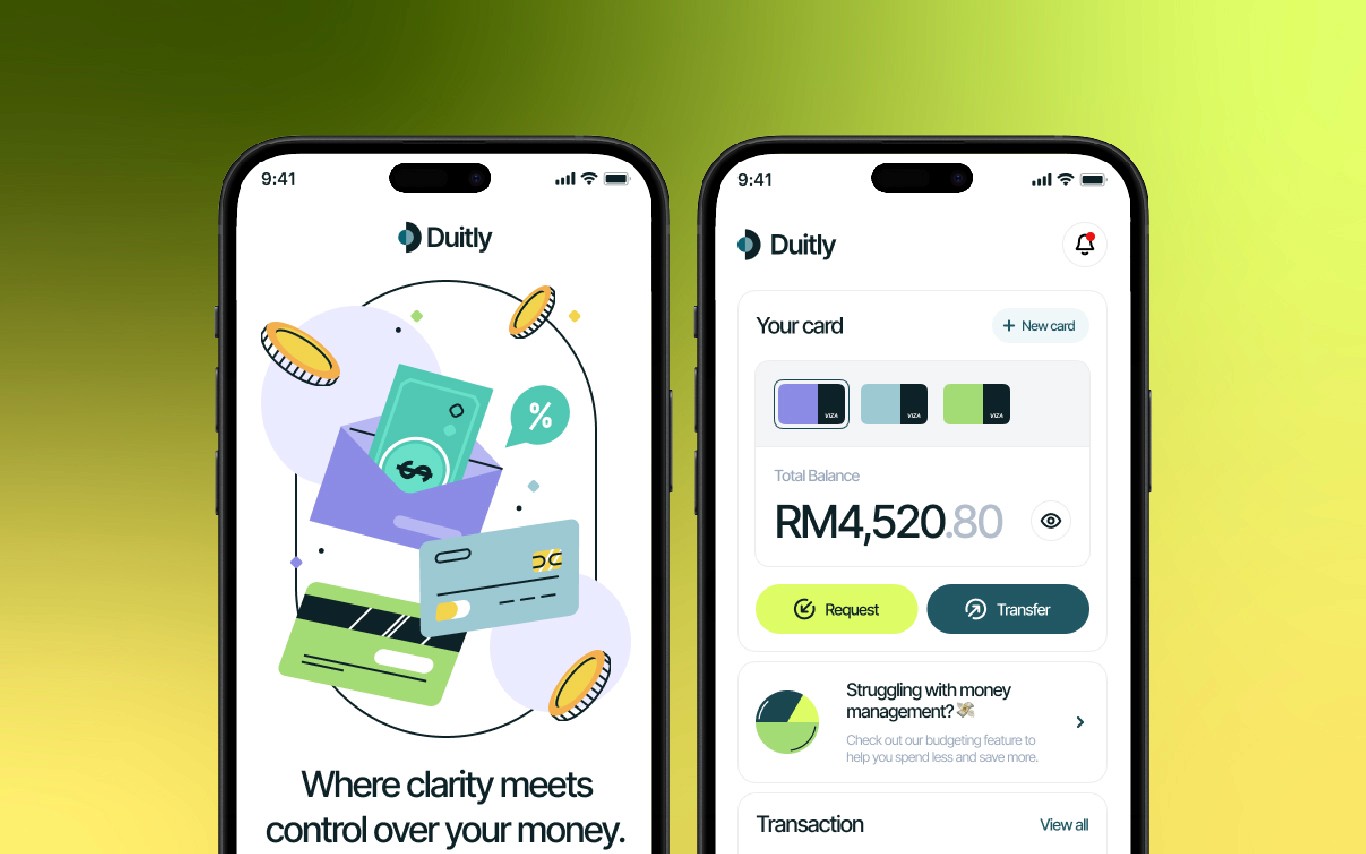

Duitly is a financial management app concept that focuses on bringing clarity, motivation, and control to users’ financial lives. It combines real-time account tracking, actionable insights powered by AI, and intuitive goal-setting features to help users take charge of their money and make progress toward what matters for them.

This project was part of my journey through the Stanford Product Management Accelerated Online Program, where I applied product management frameworks to create a practical, executable plan. While Duitly is a mock project, it reflects a serious effort: a thoughtful blueprint that could one day be built.

My contribution

User Research

UX Design

Product Strategy

Product Costing

Product Marketing

The team

Individual Effort

Year

2024

Research Approach

A mixed-methods technique that included qualitative interviews, surveys, and competitive analysis helped me figure out the main problems users have with managing their money. Each step was meant to help me learn more about how users behave and what they need while also showing me clear chances to be creative.

Qualitative Insights

I began by conducting several in-depth interviews with individuals across various income levels and life stages. These interviews focused on uncovering the emotional and practical barriers users encounter when managing their money. Key insights included:

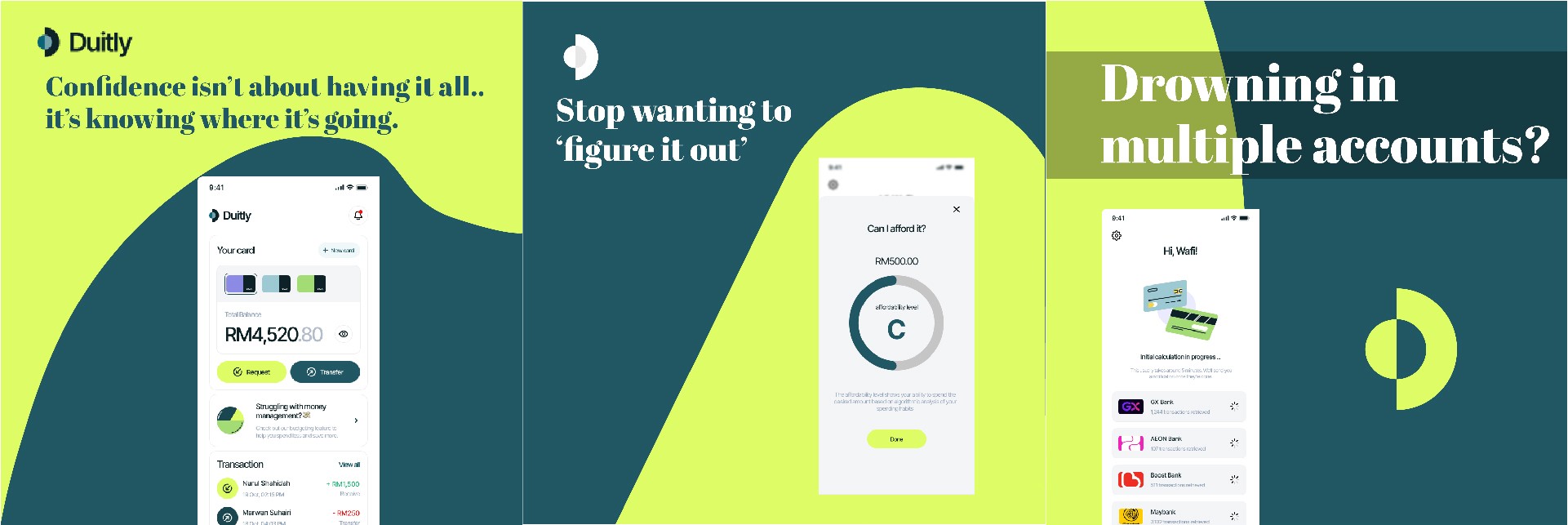

"I’m overwhelmed by juggling multiple accounts": Many users expressed frustration at switching between bank apps and credit card statements to piece together their financial picture.

"Budgeting feels like a chore": The cognitive load of manually tracking expenses often led users to abandon existing tools.

"I want a tool that helps me reach my goals": Users wanted to see how daily spending decisions connect to long-term aspirations, such as saving for a home or reducing debt.

Quantitative Validation

To validate the qualitative findings, I distributed a survey to over 100+ participants via my network. The survey revealed:

80% of respondents struggled to track their spending across multiple accounts.

65% were dissatisfied with existing tools due to a lack of personalized insights.

70% wanted a financial app that prioritized goal setting and progress tracking.

Competitive Analysis

When I looked at competetitors like Mint and YNAB, I saw big holes in how other tools met users' needs. Even though these tools had powerful tracking and planning features, they didn't always work well with different types of accounts or have useful features for keeping track of goals. Also, a lot of people used these platforms but thought they were either too simple or too complicated, which left a big hole in the middle. This hole became one of the main things that made Duitly valuable: it made it easy to connect real-time tracking of expenses with long-term financial goals.

Designing The Solution

Ideation Process

Designing a solution to address the identified pain points required a structured approach. I employed the divergence-convergence framework to encourage creativity while maintaining focus on user needs. The process was informed by user interviews, competitive analysis, and iterative prototyping.

Divergent Phase

In the divergent phase, I focused on brainstorming innovative ideas that could address the most critical user challenges. This phase encouraged thinking beyond conventional solutions and led to concepts such as:

Real-time Account Aggregation: Users could view all their financial accounts in a single, unified dashboard. This idea stemmed from interview feedback where users mentioned frustration with fragmented tools.

Gamified Financial Health Score: A fun and engaging way to motivate users by providing a tangible score based on their financial habits.

Goal-Oriented Budgeting: A feature to align daily spending with long-term aspirations like saving for a car or reducing debt.

Convergent Phase

During the convergence phase, I evaluated the feasibility, impact, and user desirability of the proposed ideas. Through this analysis, three key pillars emerged as the foundation of Duitly:

Unified Dashboard: A holistic view of all financial accounts to reduce the cognitive burden of managing multiple tools.

AI-Powered Insights: Automated categorization of expenses and tailored recommendations to empower users with actionable financial strategies.

Goal-Driven Planning: A progress-tracking system that connects daily spending to long-term financial objectives.

This prioritization ensured the final solution was practical, impactful, and aligned with user needs.

Translating Ideas into Prototypes

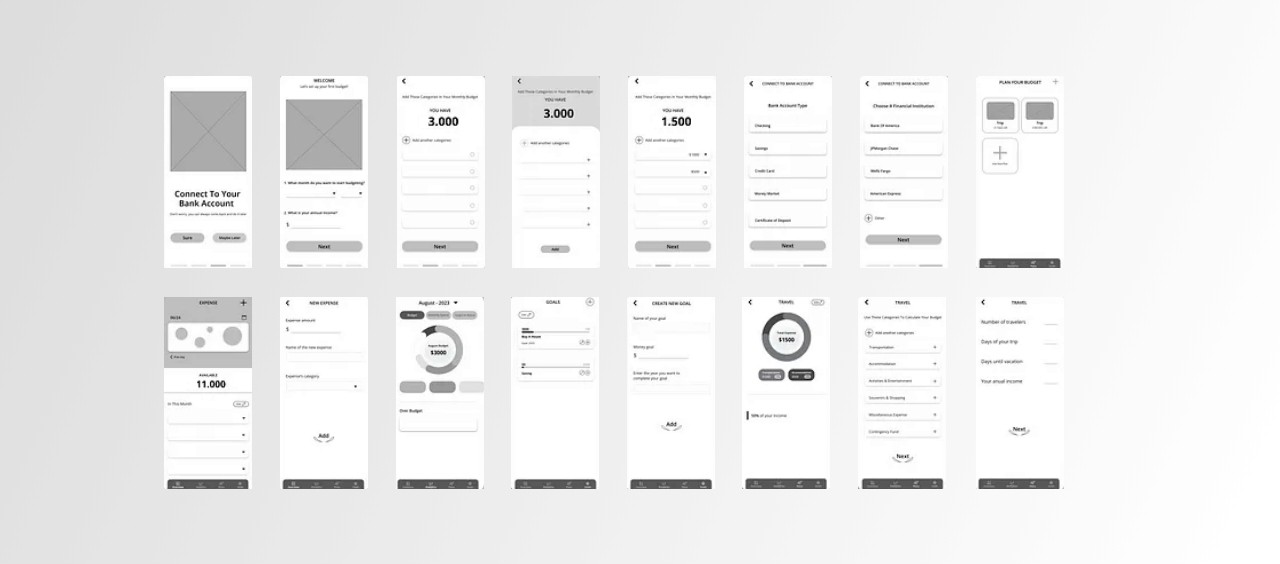

To validate the concepts, I created the user journey & low-fidelity prototypes using Figma. Each prototype was designed to test the key pillars from the Divergent & Convergent phase

The Final 'Feature' List

[Dynamic Spendable Balance]

The Spendable Balance feature provides a real-time calculation of funds available for spending after accounting for predicted income and recurring expenses. This dynamic adjustment ensures a clear understanding of financial standing as new transactions occur, simplifying the process of budgeting and decision-making.

[Bank Sync and Manual Inputs]

Bank Sync enables seamless integration with over 12,500 financial institutions, automating the import of transactions for accurate and up-to-date tracking. For flexibility, manual input options are included, allowing the addition of one-off expenses or cash transactions. This combination ensures comprehensive financial records tailored to individual needs.

Recurring Expense Detection

Recurring expenses are automatically identified and categorized through intelligent algorithms. These include payments such as subscriptions, loans, and utilities, which are displayed in a dedicated list. Customization options allow for the exclusion of specific items or reclassification of non-recurring transactions, providing a tailored expense tracking experience.

[Goal-Based Planning]

The Goals feature supports financial planning by enabling the creation of short-term, mid-term, or long-term objectives. Monthly contributions required to meet these goals are calculated automatically and factored into the overall budget, ensuring progress without requiring constant manual adjustments. This promotes consistent saving behavior aligned with individual aspirations.

[Affordability Calculator]

The "Can I Afford It?" feature evaluates the feasibility of purchases by analyzing current and predicted cash flow. Each potential transaction is assigned a confidence grade (A, B, C, D, or F) based on historical spending patterns and future obligations. This analysis aids in informed decision-making and reduces the risk of unsustainable expenditures.

[Advanced Expense Filters]

Advanced filters offer detailed insights into financial transactions by allowing categorization based on criteria such as income vs. expense, recurring vs. non-recurring, and manual vs. synced entries. Sorting options enable the identification of trends or anomalies, enhancing the understanding of spending patterns and overall financial management.

[Proactive Notifications]

Proactive notifications improve financial management by delivering timely updates on critical activities. These include reminders for upcoming large bills, alerts for unusual transaction activity, and notifications for missed recurring payments. By ensuring that important updates are highlighted, this feature helps maintain financial stability and reduces the likelihood of oversight.

Product Strategy

Roadmap Development

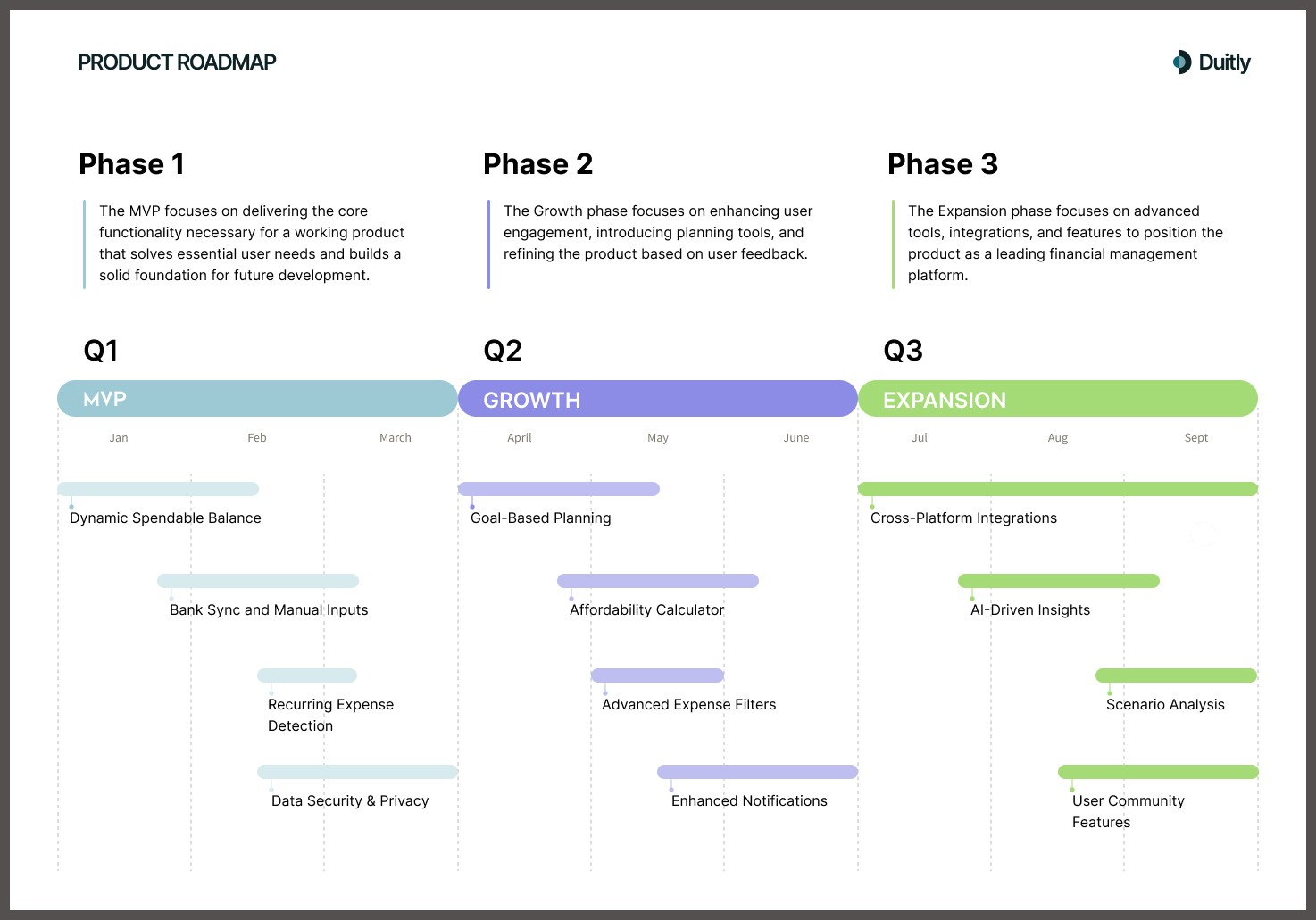

I broke the product roadmap into three clearly defined phases, each grounded in user feedback and strategic goals:

Execution Framework

The execution framework outlined for Duitly’s roadmap serves as a framework to guide development, testing, and product evolution. It represents a well-reasoned approach to achieving product success but has not yet been fully executed. The framework acts as a strategic blueprint, shaped by user research, market analysis, and a clear focus on delivering value incrementally while maintaining flexibility to adapt as new insights emerge.

When building this strategy, I focused on three critical principles: iterative development, user validation, and scalability. Each phase was designed to tackle a specific stage of the product journey - starting with a functional foundation, moving to engagement and personalization, and finally, achieving market expansion. The structured Build-Measure-Learn cycle underpins every decision, ensuring that features align with user needs while reducing risks.

Phase 1: MVP (Q1) - Foundation and Core Delivery

My thought process began with the realization that a product cannot succeed without solving a fundamental problem first. Users expressed frustration with fragmented financial tools, so the MVP focuses on essential features that establish reliability:

Dynamic Spendable Balance and Bank Sync address the user pain of financial fragmentation, offering clarity through real-time account aggregation.

Recurring Expense Detection ensures users can identify and manage their recurring spending habits effortlessly.

Data Security provides trust and compliance, which are non-negotiable for financial products.

This phase is about answering a simple question: “Does the product work?” I prioritized building a stable, functional core while validating it with usability testing to reduce assumptions and improve the user experience.

Phase 2: Growth (Q2) - Enhancing Engagement and User Value

With a functional MVP, the next challenge is to retain users and deepen engagement. My thought process here centered on personalization and actionable insights:

Goal-Based Planning allows users to align daily spending with meaningful milestones, directly addressing their desire for control over long-term goals.

The Affordability Calculator introduces AI-powered predictions to guide users' spending behaviors, helping them understand what they can afford without compromising their goals.

Expense Filters and Notifications create a feedback loop, ensuring users stay aware of their progress and receive timely nudges to stay on track.

The idea is to create a product that becomes indispensable by delivering value at an individual level - a tool that grows smarter with each user interaction.

Phase 3: Expansion (Q3) - Advanced Tools and Market Positioning

For long-term success, I needed to consider scalability and market positioning. This phase aims to transform Duitly into a comprehensive financial management platform:

Cross-Platform Integrations improve accessibility, making the app a consistent companion across devices.

AI-Driven Insights expand predictive capabilities, offering behavioral analysis and actionable financial recommendations that elevate the user experience.

Scenario Analysis enables advanced users to simulate outcomes for better financial planning, addressing power users' needs for sophisticated tools.

Community Features engages user by creating a space for shared financial advice and challenges, tapping into the psychological need for peer validation.

This phase reflects my belief that products succeed when they evolve into ecosystems - offering tools, insights, and community that position the platform as a must-have for its audience.

Product Costing

Creating a financial platform like Duitly needed a strong awareness of product expenses to guarantee both viability and profitability. I carefully considered cost structures, assesses margins, and creates a sustainable price strategy. This part describes the exact method I used for product costing to guarantee congruence with strategic objectives, user needs, and the competitive scene.

Product costing for Duitly was segmented into direct costs, indirect costs, and variable costs to ensure a comprehensive analysis. Each component was mapped to the specific phases of development, launch, and scaling as outlined in the roadmap.

[Direct Costs: Core Resources for Product Development]

These costs were directly tied to creating and maintaining Duitly’s core functionality.

Frontend Development: Building the user interface in Figma, InVision, and ReactJS. This required hiring freelance UI/UX designers and a development team.

Estimated Cost: RM230,000 for initial prototyping and MVP build-out.

Backend Infrastructure: Real-time account aggregation necessitated robust APIs (e.g., Plaid) for syncing with banks and credit cards.

Licensing and integration costs: RM115,000/year.

Cloud hosting (AWS): RM37,000/year for MVP scaling.

AI and Machine Learning Feature: Creating AI-powered insights and personalized recommendations demanded computational resources and data scientists to build and test algorithms.

Initial development: RM138,000 for an AI model trained on anonymized financial datasets.

Maintenance and retraining: RM46,000/year.

[Indirect Costs: Supporting Infrastructure and Operations]

These costs were necessary for the broader functioning of the product but not directly tied to features.

Marketing and User Acquisition As an early-stage platform, marketing accounted for a significant portion of the budget.

Social Media Campaigns: Targeting young professionals and families with tailored messaging. Budget: RM92,000/year during the growth phase.

Referral Incentives: RM46 per new user acquisition, estimated for the first 10,000 users. Totaling RM460,000.

Team Salaries and Overheads The team structure included:

Product Manager (self): Opportunity cost valued at RM368,000/year.

Developers (2): RM552,000/year.

Marketing Manager: RM322,000/year.

Customer Support (freelancers): RM138,000/year.

Miscellaneous Overheads This included office tools, software subscriptions (e.g., Slack, Linear), and administrative expenses, estimated at RM23,000/year.

[Variable Costs: Scaling with User Growth]

These costs grew with user adoption, critical for assessing long-term scalability.

API Usage Plaid and similar services charged per connected account beyond the free tier. For every additional user connecting accounts:

Cost per user: RM1.15/month.

Estimated Year 1 user base: 20,000 users.

Projected Annual Cost: RM276,000.

Cloud Storage and Computing Growth in user accounts meant higher storage costs for user data and analytics.

Incremental Cost: RM0.23/user/month.

Projected Annual Cost for 20,000 users: RM55,200.

Cost Modeling and Forecasting

I built a financial model to map the cost of customer acquisition (CAC), lifetime value (LTV), and break-even points based on these expenses.

CAC Calculation

By analyzing marketing spend and user acquisition incentives:

CAC for early-stage users = Total Marketing Spend ÷ Number of Users Acquired.

With a RM552,000 marketing budget targeting 10,000 users: CAC = RM55.20/user.

LTV Estimation

Based on user surveys, I assumed an average monthly subscription fee of RM37, with a churn rate of 5% per month.

LTV = Monthly Revenue Per User ÷ Churn Rate.

LTV = RM37 ÷ 0.05 = RM740/user.

Break-Even Analysis

I estimated the break-even point by balancing CAC, variable costs, and expected revenue.

For 10,000 users: Revenue = RM37 × 10,000 × 12 months = RM4,440,000/year.

Total Costs for Year 1: Direct (RM644,000) + Indirect (RM1,495,000) + Variable (RM331,200) = RM2,470,200.

Break-even = Total Costs ÷ Revenue Per User.

RM2,470,200 ÷ RM37 = ~66,758 user-months or ~5,563 users sustained for a year.

Product Marketing

Coming up with a marketing plan for Duitly was like writing a story that would emerge in every conversation with possible users. I focused on knowing user needs, expressing value clearly, and making the path from knowledge to adoption as smooth as possible. The process was abstract, but every choice was based on making a marketing story that was focused on the customer.

Understanding the Customer

At the heart of the marketing strategy was a deep dive into user personas. Drawing from earlier research, I identified three core segments:

Young Professionals: Time-starved individuals juggling multiple responsibilities who craved simplicity in managing finances.

Freelancers: Users with fluctuating income streams who needed tools to manage cash flow and plan for taxes.

Families: Budget-conscious households seeking tools to align spending with savings goals.

Communicating Value: The Messaging Framework

I structured Duitly’s messaging around three pillars:

1. Simplify Your Finances

To appeal to overwhelmed users, the messaging emphasized Duitly’s unified dashboard and real-time expense tracking. Phrases like "All your accounts, one simple view" conveyed clarity and ease.

2. Achieve Your Goals

Goal-oriented budgeting was highlighted as a unique feature. Ad copy focused on relatable aspirations, such as "Save for your dream home while enjoying your daily coffee."

3. Financial Confidence

For users hesitant about managing money, the messaging framed Duitly as an empowering tool. Testimonials and success stories were used to inspire confidence, positioning Duitly as a trusted partner in their financial journey.

Rollout Plan

To bring the marketing strategy to life, I developed a phased rollout plan that ensured every campaign and initiative was timed to maximize impact and reach.

Phase 1: Pre-Launch (Month 0-2)

The pre-launch phase is important for building excitement and forming a connection with the target audience. The plan aims to create interest and excitement around Duitly through teaser campaigns and collaborations with influencers. This phase helps create a solid list of potential users by encouraging early access sign-ups, making sure there’s an audience ready for the launch.

Key Initiatives:

Build Anticipation:

Launch teaser campaigns across major social media platforms.

Use cryptic, engaging video snippets hinting at "the future of managing money."

Monitor engagement metrics (likes, shares, comments) to identify resonating themes.

Influencer Partnerships:

Partner with micro-influencers in the personal finance niche.

Equip influencers with key talking points, ensuring organic integration of messaging.

Track mentions, impressions, and follower growth.

Early Access Sign-Ups:

Develop a dedicated landing page featuring a clear call-to-action.

Emphasize exclusivity (e.g., "Be the first to experience Duitly").

Utilize A/B testing to optimize the page’s conversion rates.

By the end of this phase, the desired outcome is to have a waitlist of more than 10,000 interested early adopters. This audience will enhance launch efforts and generate excitement within the personal finance community, paving the way for a successful debut.

Phase 2: Launch (Month 3)

The launch phase is all about creating a memorable first impression. By bringing together focused advertising, useful content, and a clear referral program, this method draws in a wide range of users while strengthening Duitly’s position in the market. The initiatives aim to promote quick adoption and understanding.

Key Initiatives:

Targeted Ads:

Leverage Google Ads and social media platforms for precision targeting.

Focus on high-intent keywords like “personal finance management” and “budgeting tools.”

Optimize campaigns weekly based on ROI metrics.

Content Hub Launch:

Publish high-value blogs and guides to position Duitly as a thought leader.

Ensure seamless distribution through newsletters and social media.

Embed strong CTAs in content to drive conversions.

Referral Program Kickoff:

Launch a simple, rewarding referral program (e.g., “Invite 3 friends, earn 6 months free”).

Use gamification to encourage sharing.

Track referral-based sign-ups in real-time.

The launch is expected to welcome more than 20,000 new users in the first month, setting a strong base for future growth. The referral program will enhance user acquisition efforts, helping to maintain steady progress during this phase.

Phase 3: Post-Launch Momentum (Month 4-6)

After the launch, the focus turns to keeping early users engaged and building trust in Duitly. The plan focuses on creating personal connections through email campaigns and informative webinars, helping to keep users engaged and build trust in the brand. This stage focuses on collecting and responding to user feedback to enhance the platform over time.

Key Initiatives:

Email Campaigns:

Implement behavior-based email sequences (e.g., “We noticed you’ve set a budget—here’s how to optimize it”).

Offer exclusive tips and access to premium content to nurture users.

Webinars:

Host live webinars tailored to key user segments (e.g., “Financial Planning for Freelancers”).

Collaborate with industry experts to enhance credibility.

Feedback Loops:

Deploy in-app surveys and interviews with early adopters.

Actively address concerns and communicate improvements to maintain trust.

By the end of this phase, expectations are for more than 60% of users to stay engaged. Also, input from early users will help us refine our messaging and product offerings, leading to lasting satisfaction and growth.

Phase 4: Scaling (Month 7-12)

The scaling phase focuses on broadening Duitly’s presence and promoting lasting sustainability. By using effective SEO methods, forming valuable partnerships, and creating focused nurture campaigns, the plan seeks to strengthen Duitly’s role as a top financial tool while promoting steady user growth and revenue.

Key Initiatives:

SEO Optimization:

Develop in-depth content targeting long-tail keywords (e.g., “best budgeting tool for families”).

Partner with finance bloggers and publications for backlinks.

Track rankings and organic traffic growth.

Expanded Partnerships:

Collaborate with banks, tax consultants, and HR departments to integrate Duitly as an added-value service.

Develop co-branded marketing campaigns with partners.

Nurture Campaigns:

Focus on converting free-tier users into paying customers.

Highlight premium features and showcase success stories.

This phase focuses on increasing the user base to more than 100,000 by the end of the first year. Duitly will build solid relationships and use straightforward marketing approaches to create a strong presence in the personal finance area, promoting steady growth and staying relevant in the market.

Outcome

Beyond frameworks and tactics, this conceptual project truly tested my skills in researching, adaptability, and problem-solving.

Product management requires balancing trade-offs and navigating uncertainty. Iteration and the self-discipline to focus on what's truly important are the building blocks of clarity, not a magic formula. For instance, it was always a critical thinking exercise to decide whether to invest in more complex features for future scalability or choose simplicity for an MVP.

Another thing I picked up is viewing product development as a connected system, where strategy, execution, and outcomes feed into each other. Strategy lays the foundation by defining the “why” - the problem we’re solving, the target audience, and the value we aim to deliver. Execution, on the other hand, brings the strategy to life, turning abstract goals into tangible results. However, execution alone isn’t enough; it needs to be measured against meaningful outcomes to ensure alignment with the original vision.